CSI understands how important financial security is for you to live the present & protect the future

Crescent Star Insurance Limited (CSI) is a registered insurer with the Securities & Exchange Commission of Pakistan with a paid up capital of PKR. 1,077 million. The company is listed on the Pakistan Stock Exchange. It is also a member of Insurance Association of Pakistan (IAP).

By providing both individuals and businesses with a variety of insurance products offer financial protection.

Why Insure with CSIL?

At Crescent Star Insurance Ltd (CSIL), we don’t just sell insurance — we deliver confidence, continuity, and care. As one of Pakistan’s longest-standing listed insurance companies, with a proud legacy since 1957, CSIL has evolved with the times while staying rooted in integrity and client commitment.

In a market where many providers offer similar products, CSIL stands apart through a differentiated approach that combines financial prudence, regulatory compliance, and customer-centric innovation. We specialize in select insurance classes where we maintain in-house expertise and reinsurance support, ensuring every policy issued carries both security and service value.

What Makes CSIL Different?

Stable Governance & Visionary Leadership

Since its strategic revival under new leadership in 2013, CSIL has undergone a complete transformation, focusing on solvency, governance, and sustainable growth. Our Board comprises a diverse, qualified, and independent team that puts client trust at the core of decision-making.

Focused Product Strategy

We do not chase volumes — we pursue value. CSIL focuses on specialized lines such as Guarantees, Travel, and Health, supported by adequate and reliable reinsurance arrangements. This means our clients benefit from high-risk capacity with reduced operational complexity.

Strong Capital Base & Transparent Financials

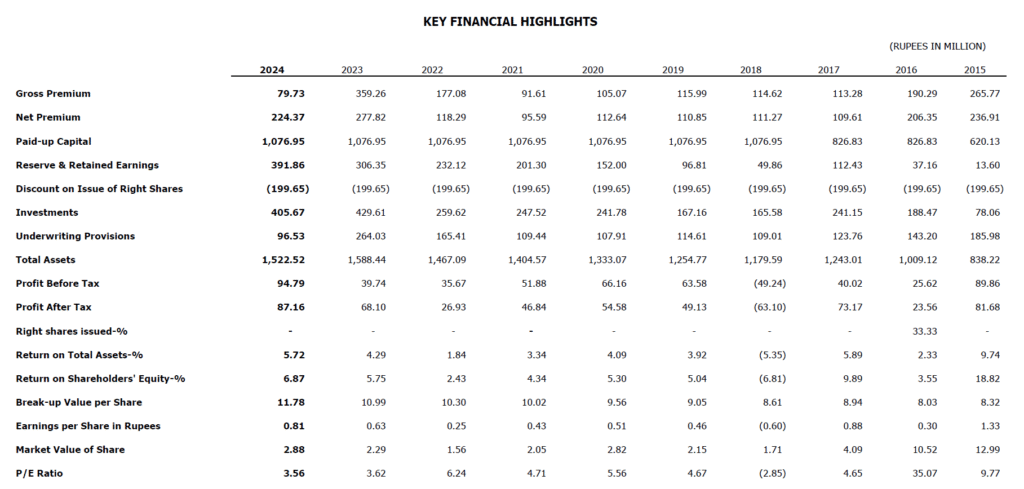

CSIL has consistently met and exceeded minimum capital and solvency requirements. All our financials are publicly available and regularly reviewed by independent auditors and regulators, ensuring complete transparency for policyholders and investors alike.

Regulatory Compliance & Advocacy

CSIL is one of the few insurance companies consistently highlighting — in our financial reports and at industry forums — the barriers smaller compliant insurers face, such as exclusion from government and banking panels. We strongly advocate for open market access as a right for all compliant insurers under the Insurance Ordinance and Competition Act.

Adequately Reinsured with Reliable Reinsurance Covers

Every policy we issue is backed by appropriate reinsurance — whether local or international — giving our clients confidence that their coverage is supported by sound financial protection.

Innovation with Purpose

From pioneering capital market-driven growth models to exploring insurance-linked investment platforms, CSIL is reshaping what an insurance company can achieve in Pakistan. We’re more than insurers — we’re enablers of opportunity.

Our Promise to You

When you choose CSIL, you’re choosing a partner that:

- Protects your interests with integrity and accountability

- Backs every policy with adequate capital and reliable reinsurance

- Believes insurance is a right, not a privilege granted by panels

- Combines a heritage of trust with a vision for the future

Whether you are an individual, a business, or an investor, CSIL stands ready to insure not just your risk — but your trust.

CSIL – Associated Companies!

Crescent Star Foods (Private) Limited

Crescent Star Technologies (Private) Limited